MUMBAI: India's entertainment scene has never lacked drama, but now it is scripting a blockbuster for the world stage. Content India’s latest report, ‘The Future Of The Indian Entertainment Business In Partnership With The World’, published today, sets a racy new agenda: a potential $6 billion boost to the industry by 2030 if India plays its cards right.

The findings, drawn from the one-day Content India Summit in Mumbai on 1 April and powered by data from Allied Global Marketing, outline how global partnerships, technology adoption, and a sharper content game could fuel India’s charge. The event, a DishTV and C21Media collaboration, has paved the way for a three-day Content India bash in March 2026.

"It is clear that the Indian entertainment business is a force to be reckoned with on the global stage. But it has the opportunity to make an even bigger impact globally by partnering with international players on its own terms," said DishTV CEO & ED Manoj Dobhal.

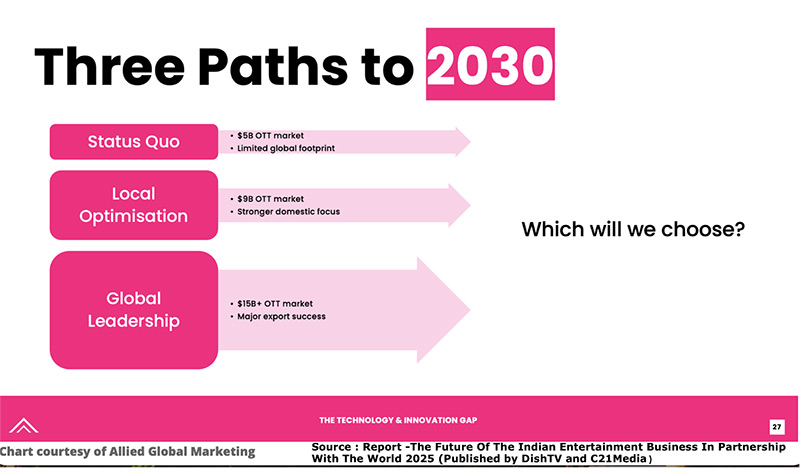

Currently, India’s 551 million OTT users deliver just $2.1 billion in revenue. In contrast, South Korea’s entertainment exports dominate global charts. Without change, India’s OTT pie might touch $5 billion, or $9 billion with minor local fixes. But bold action could unlock a whopping $15 billion market, transforming India into a global soft power, argued Allied’s Jamie Crick at the summit.

The report flagged gaping gaps. Comedy tops audience preference (30 per cent), yet only 10 per cent of premium content serves laughs, while drama, crime, and thrillers hog 60 per cent of new releases. Authentic, local content—preferred by 86 per cent of OTT viewers—is a must.

Mobile may be India's stereotype, but connected TVs are booming. YouTube’s connected TV usage quadrupled between 2022 and 2024. Ninety-two percent of online video minutes flow through YouTube, not premium OTT.

The report pushed for lighter, family-friendly formats and deeper collaboration with creator ecosystems.

On the global stage, India can draw lessons from South Korea’s Hallyu wave and Spain’s Money Heist effect. Local authenticity with universal themes wins hearts—domestically and internationally.

New growth drivers include positioning India as the world’s most cost-effective production partner, leveraging its premium series costs ($1 million-2 million per episode) compared to US ($5 million-15 million). AI-powered efficiencies can further sweeten the deal.

The Indian diaspora—35 million affluent consumers—remains an underplayed hand. Targeting them with broader genres, beyond nostalgia, offers a smart bridge to global glory.

C21Media founder and the report’s editor David Jenkinson summed it up, "The world is changing fast... India can be at the heart of that. Of course, there are many challenges. But they are all addressable and the upside is significant for all."

The report stressed a tight checklist for future growth: urgent action, strategic alliances, tech savviness, emotionally rich storytelling, and strong institutional backing.

"The future of Indian entertainment will not be gifted. It must be built", it concluded.

Follow Us

Follow Us