MUMBAI: Netflix smashed expectations in its first quarter of 2025, raking in $10.54bn in revenue—up nearly 13 per cent from last year—as the streaming titan shifts the spotlight from subscriber counts to cold, hard cash.

The platform’s earnings per share soared to $6.61, comfortably beating Wall Street’s forecast of $5.71, while net income hit $2.89bn, up from $2.33bn a year ago. Operating income leapt 27 per cent to $3.35bn, pushing the margin up to 31.7 per cent.

This was Netflix’s first earnings show without revealing its subscriber count, a move designed to pivot focus onto financial muscle and engagement rather than the once-sacrosanct user numbers. With pricing bumped up in key markets and a small but growing ad business, the company managed to woo both viewers and investors alike.

Shares gained around three per cent in after-hours trading, closing Thursday at a sizzling $973. Netflix also doubled down on its full-year revenue forecast of $43.5bn–$44.5bn, projecting a 15 per cent year-on-year lift for Q2, with a beefier operating margin of 33 per cent.

Shares gained around three per cent in after-hours trading, closing Thursday at a sizzling $973. Netflix also doubled down on its full-year revenue forecast of $43.5bn–$44.5bn, projecting a 15 per cent year-on-year lift for Q2, with a beefier operating margin of 33 per cent.

By region, the US and Canada contributed $4.62bn (up 9 per cent), EMEA rose 15 per cent to $3.41bn, Latin America clocked $1.26bn (up 8 per cent), while Asia Pacific surged 23 per cent to hit the same $1.26bn mark.

On the content front, the UK’s moody miniseries Adolescence got a nod for driving eyeballs, alongside action flicks Back in Action, Ad Vitam and Counterattack. WWE’s Monday Night Raw also proved a global hit, cracking the streamer’s weekly top 10 since its January debut.

The company launched its in-house ad tech platform in the US in April, touting it as a foundation for “enhanced targeting, snazzier formats and programmatic wizardry” in the quarters ahead.

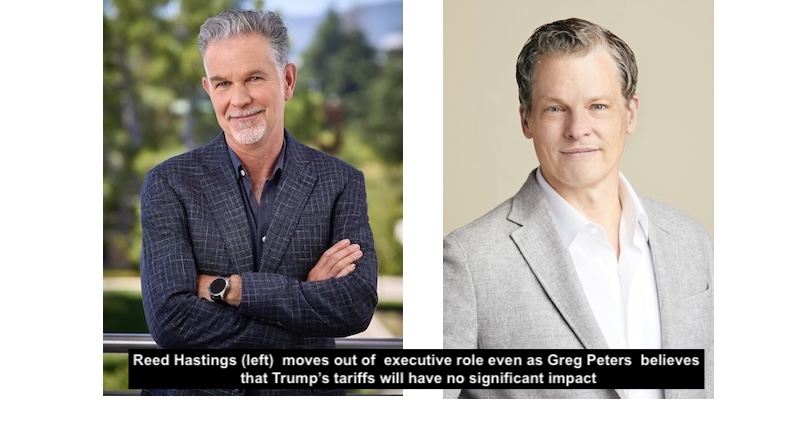

While economic clouds hover—thanks to tariff turmoil under President Trump 2.0—co-chief executive Greg Peters struck a bullish tone.

“Based on what we are seeing by actually operating the business right now, there’s nothing really significant to note. We also take some comfort that entertainment historically has been pretty resilient in tougher economic times. Netflix, specifically, also, has been generally quite resilient. We haven’t seen any major impacts during those tougher times, albeit over a much shorter history,” he said, adding that Netflix’s cheaper ad tier gives it added economic resilience.

The earnings bonanza was capped off with a curtain call from co-founder Reed Hastings, who stepped down as executive chairman to become a non-executive chair—marking the end of an era for the man who helped binge-watching go mainstream.

And just to keep Wall Street happy, Netflix threw in some shareholder candy too—buying back 3.7 million shares for $3.5bn and paying down $800m in debt. Still, with $15.1bn in debt on the books and $7.2bn in the bank, the company isn’t quite ready to roll the end credits.

Follow Us

Follow Us