MUMBAI: India’s telecom sector added a modest 2.1 million net subscribers in January 2025, nudging the total count to 1.19 billion, according to the Telecom Regulatory Authority of India’s monthly data release. But it wasn’t all smooth signal—wireline connections tanked, dropping over 10 per cent as TRAI shifted 5G Fixed Wireless Access (FWA) from wired to wireless accounting.

Mobile still rules the roost, with 1.16 billion users riding the wireless wave, including 5.7 million FWA users. Urban India continued to drive growth, adding over 5 million new mobile connections. Meanwhile, rural areas quietly chipped in with just under a million more.

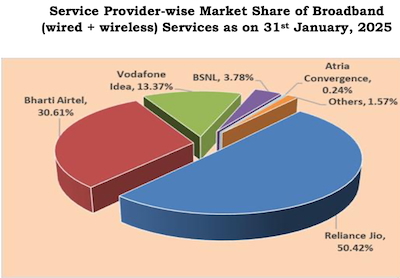

Broadband subscriptions inched up 0.04 per cent to 945.16 million—an uninspiring climb, considering Reliance Jio and Bharti Airtel hold over 80 per cent of the market. Wireline broadband, meanwhile, shrank slightly as users cut the cord in favour of FWA. Mobile Number Portability (MNP) remained red-hot with 14.14 million requests in Jan alone—pushing the all-time tally past 1.09 billion. Uttar Pradesh (East) and Maharashtra topped the charts for most switched loyalties.

Mobile Number Portability (MNP) remained red-hot with 14.14 million requests in Jan alone—pushing the all-time tally past 1.09 billion. Uttar Pradesh (East) and Maharashtra topped the charts for most switched loyalties.

The market remains firmly in private hands, with Jio and Airtel leading across broadband and mobile.

Government-owned players like BSNL and MTNL continue to struggle, holding just 8 per cent of wireless subscribers and less than a quarter of the wireline market.

Tele-density stood at 84.54 per cent—Delhi being the most connected with an eye-popping 274 per cent, while Bihar lagged behind at 56.6 per cent.

And while fixed lines may be flatlining, India’s telecom story continues to be a mostly wireless wonder.

Follow Us

Follow Us