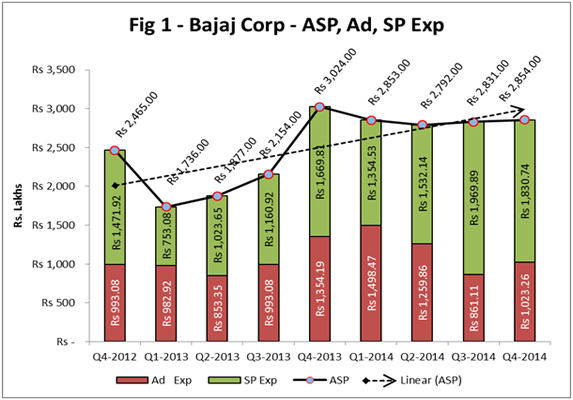

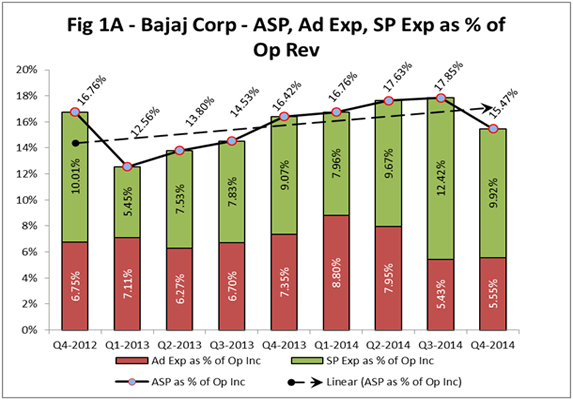

BENGALURU: Note: (1) Bajaj Corp’s Advertisement and Sales Promotion (ASP) expense comprises two parts – Advertisement (Ad Exp) and Sales Promotion (SP). The ASP figures have been obtained from the Company’s investors’ presentations over various quarters and the Ad Exp from its financial results. SP results have been obtained by deducting the Ad Exp from the ASP Exp. The figures in the investors’ presentations have been rounded off by the company and hence are assumed as approximate. Consequently the SP figures are assumed to be approximate.

(2) Rs 100 lakh = Rs100,00,000 = Rs 1 crore = Rs 10 million

Bajaj Corp Limited (Bajaj Corp) spent 10.98 per cent more towards Ad and Sales Promotion Expense (ASP) in FY-2014 at Rs 113.30 crore (16.87 per cent of Operating Income or Op Inc) as compared to the Rs 87.92 crore (14.49 per cent of Op Inc) in FY-2013. The breakup of these figures was – FY-2014 Ad Exp Rs 46.427 crore (6.91per cent of Op Inc), SP Rs 66.872 crore (9.96 per cent of Op Inc) and FY-2013 Ad Exp Rs 41.8354 crore (6.90 per cent of Op Inc), SP Rs 46.0846 crore (7.60 per cent of Op Inc). During three financial years from FY-2012, to FY-2013, ASP, Ad Exp and SP show an increasing trend in terms of absolute value in rupees as well as in terms of percentage of Op Inc.

Bajaj Corps ASP was just 0.81 per cent more in Q4-2014 at Rs 28.54 crore (15.47 per cent of Op Inc) as compared to the Rs 28.31 crore (17.85 per cent of Op Inc) in the immediate trailing quarter Q3-2014 and (-5.62) per cent lower than the Rs 30.24 crore (16.42 per cent of Op Inc) during the year ago quarter of Q4-2013. Please refer to Fig 1 and Fig 1A below for more details and breakup of ASP. Overall, during nine quarters starting from Q4-2012 until Q4-2014, ASP shows an upward trend in absolute rupee value terms as well as in terms of percentage of Op Inc.

|

|

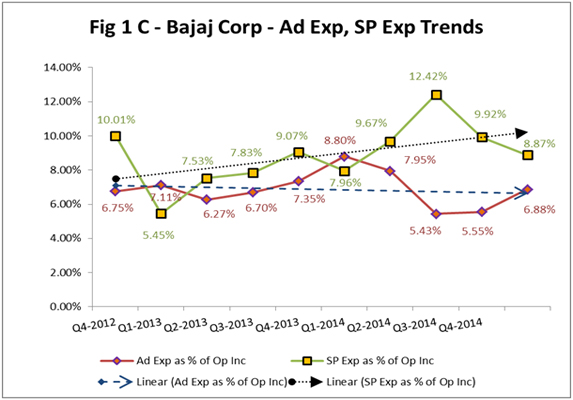

Fig 1C below indicates that over the nine quarters under consideration, Ad Exp show a decreasing trend, while SP shows an increasing trend.

|

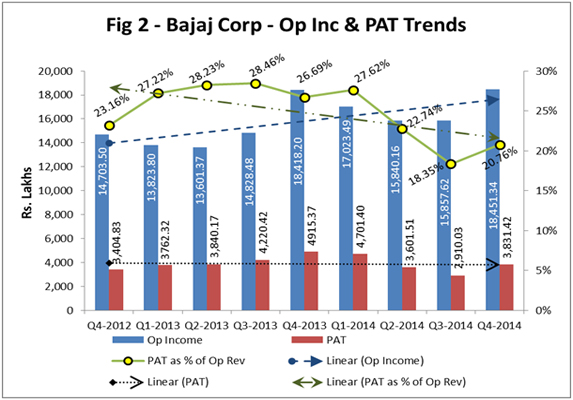

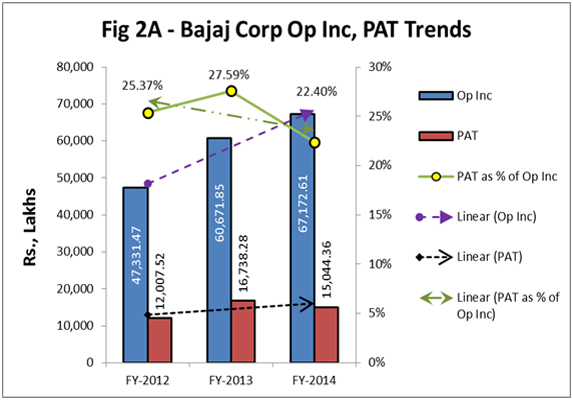

Fig 2 and Fig 2 A below indicate the Op Inc and PAT trends of Bajaj Corp

|

|

Bajaj Corp’s mother brand is Bajaj with sub brands/products such as Bajaj Almond Drops Hair Oil, Bajaj Kailash Parbhat Cooling Oil, Bajaj Brahmi Amla Hair Oil, Bajaj Amla Shikakai, Bajaj Jasmine Hair Oil, Bajaj Kala Dant Manjan and creams, soaps, face washes and face scrubs under the brand name Nomarks.

The company in its April 2014 investor presentation says that it intends to gain market share from other hair oil segments. To that end it intends to convert coconut hair oil users to light hair oil users through sampling, targeted advertising campaigns, product innovation and creating awareness about product differentiation including communicating the advantages of switching to lighter hair oils. It is aiming for a market share of 65 per cent by the year 2015-16.

It says that it will focus on rural penetration and tap the increase in disposable income of rural India and convert rural consumer from unbranded to branded products by providing them with an appropriate value proposition. Also, among its key competitors, Bajaj Corp’s Almond Drops is the only brand which is available in sachets – a marketing initiative to penetrate the rural market.

Bajaj Corp says that it will leverage its existing strengths to introduce new products. Bajaj Corp claims that it has over the years created a strong distribution network across 26.7 lakhs retail outlets which can be optimally utilized by introducing new products. The company intends to extend ‘Almond Drops’ platform developed by its Almond Drops Hair Oil brand to other personal care products to leverage on the strong connotation of almonds with nutrition.

It says further that it will also pursue inorganic opportunities in the FMCG and hair oil market as part of growth strategy. The inorganic growth opportunities will focus on targeting niche brands which can benefit from Bajaj Corp’s strong distribution network so that they can be made pan India brands.