NEW DELHI: Covid2019 impacted nearly every advertising medium apart from digital. Be it television, print, outdoor or experiential, ad volumes across all these mediums took a hit as the brands were uncertain about future projections at that point. However, digital grew on the back of being a cheaper medium than ATL and allowing one-on-one conversation with the user.

Print medium was further affected due to a false alarm of it being a possible carrier of virus. This resulted in a large number of pockets in the urban regions cancelling subscriptions or not letting the newspaper delivery boy come into the colonies. It further affected the subscription numbers and hence the ad volumes. Newspaper organisations had to additionally advertise to ensure that they continue to regain the trust of the audiences.

Industry leaders have acknowledged the decrease but are anticipating a better 2021 for the medium.

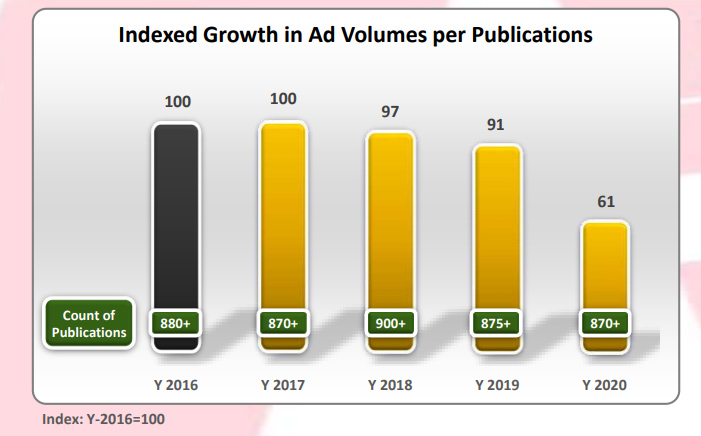

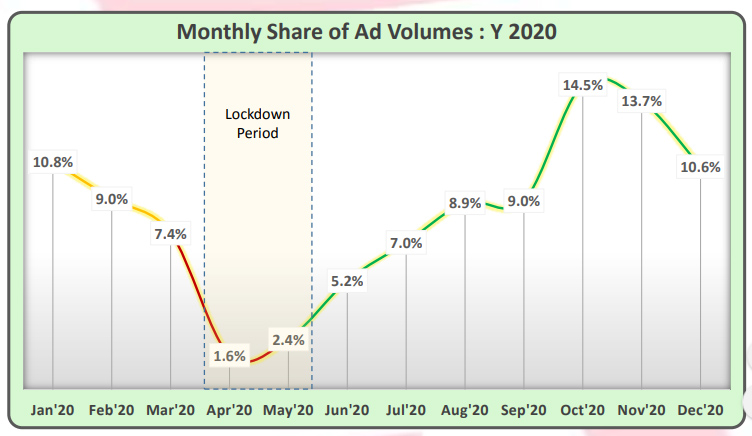

TAM recently released data that showed ad volumes per publication in print were lowest in the last five years and saw the maximum decline in April – May 2020 period.

A closer look at the data points to an obvious trend where the average ad volumes fell steeply in the initial stages of lockdown, and then started picking up early June onwards. This happened because marketing teams at brands were still unable to gauge the depth of the crisis and were unwilling to bet money on advertising in that quarter.

Auto, education and services were the leading advertisers on print, with cars, two-wheelers and property brands leading in terms of ad volumes on this medium.

SBS Biotech, Maruti Suzuki, and Hero Motocorp were the top advertisers, while Maruti, Hero Two Wheelers, and Dr Ortho Oil were the leading brands on the medium.

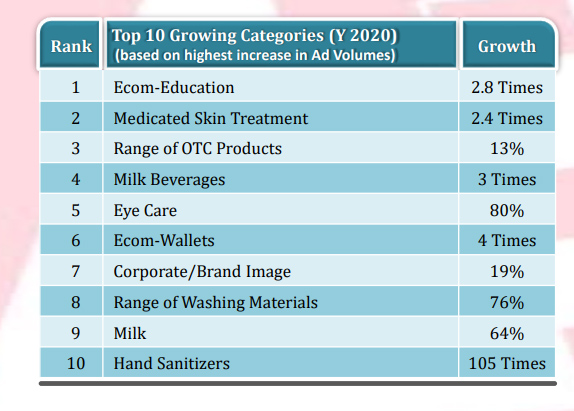

E-comm education saw the maximum increase in ad volumes on the medium.

The top formats for innovations in ad on the medium were – teaser, seamless jacket, bookmark, figure online, and French window.

The top five ad positions in year 2020 were jacket, full page, half page, solus, strip horizontal.

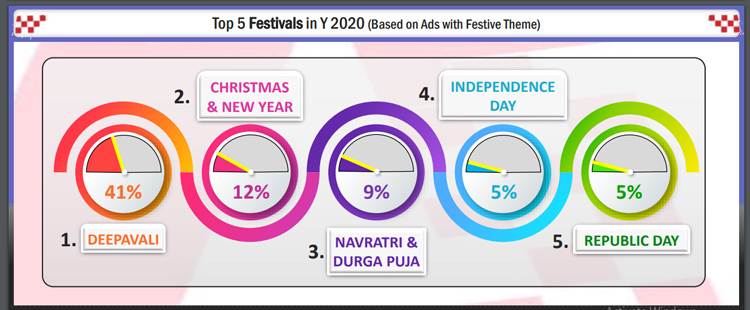

The medium recovered massively around the festive season. Diwali, Durga Puja/Navratri and Christmas contributed to nearly 62 per cent of annual overall festive advertising on print.

During the Unlock phase, the medium saw 4.8X rise in ad volumes per publication per day in comparison to the lockdown period.

Follow Us

Follow Us