BENGALURU: The Sunil Mittal-promoted Bharti Airtel Ltd (Airtel) led broadband subscriber growth, both wired as well as wired internet, for the month ended 31 January 2019 (1 January 2019 to 31 January 2019, Jan-19) according to Telecom Regulatory Authority of India (TRAI) data for the period. In Jan-19, Airtel added 0.997 crore (9.97 million, 99.7 lakh) wireless subscribers, hence upstaging the Mukesh Ambani’s juggernaut Reliance JioInfocomm (Jio) which added 0.932 crore (9.32 crore, 93.2 lakh) subscribers in Jan-19. Airtel also added 30,000 or about 30 percent to the growth of 1,00,000 in wired broadband internet subscribers Jan-19.

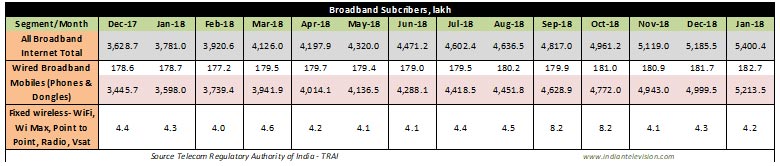

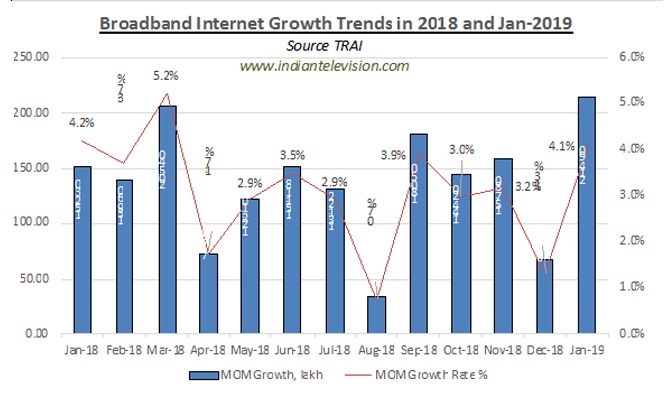

Overall, the number of broadband subscribers grew by 2.149 crore (21.49 million, 214.9 lakh) in Jan-19, much higher than the 1.532 crore (15.32 million, 153.2 lakh) subscribers that were added in Jan-18, and even higher than the 2.054 crore (20.54 million, 205.4 lakh) subscribers added in Mar-18, the month which saw the highest number of subscribers added in any month in 2018. In percentage terms, India’s broadband subscriber base grew by 4.1 percent in Jan-19 to reach 54.004 crore (540.04 million, 5,400.4 lakh) from 51.855 crore (518.55 million, 5185.5 lakh) in Dec-18.

In Jan-19, wireless broadband internet subscribers constituted about 96.5 percent of the broadband internet services base in India, followed by wired broadband internet services (3.4 percent) and Fixed Wireless subscribers (Wi-Fi, Wi-Max, Point-to- Point Radio & VSAT) at about 0.1 percent. While the subscriber base of the former two grew in Jan-19, in the case of Fixed Wireless subscribers (Wi-Fi, Wi-Max, Point-to- Point Radio & VSAT) the base declined by about 10,000 .

Please refer to the figures below:

In Jan-19, the top five service providers constituted 98.63 percent market share of the total broadband subscribers at the end of Jan-19. These service providers were Jio 28.994 crore (289.94 million, 2,899.4 lakh), Airtel 11.025 crore (110.25 million, 1,102.5 lakh), Vodafone Idea 10.986 crore (109.86 million, 1,098.6 lakh), BSNL 2.081 crore (20.81 million, 208.1 lakh) and Tata Tele group 0.226 crore (2.26 million, 22.6 lakh).

Wireless broadband internet – mobile device users (phones and dongles)

As mentioned above, India’s wireless broadband internet services have been leading broadband internet subscriber base as well as subscriber growth in the country - wireless broadband internet subscriber base grew 4.28 percent in Jan-19 to reach 52.135 crore (521.35 million, 5213.5 lakh) from 49.995 crore (499.95 million, 4999.5 lakh) at the end of Dec-18.

As on 31 January, 2019, the top five wireless broadband service providers were Jio 28.944 crore (289.44 million, 2,894.4 lakh), Vodafone Idea 10.984 crore (109.84 million, 1,098.4 lakh), Airtel 10.796 crore (107.96 million, 1,079.6 lakh), BSNL 1.164 crore (11.64 million, 116.4 lakh) and Tata Teleservices 0.179 crore (1.79 million, 17.9 lakh).

Wired broadband internet

Also, as mentioned above, India’s wired broadband internet subscribers grew by 1,00,000 (0.56 percent) in Jan-19. There were 1.827 crore (18.27 million, 182.7 lakh) wired broadband internet subscribers in the period under consideration as compared to 1.817 crore 18.17 million, 181.7 lakh) in the previous month, Dec-18.

As on 31 January, 2019, the top five wired broadband service providers were BSNL 0.917 crore (9.17 million), 91.7 lakh, Bharti Airtel 0.23 crore (2.30 million, 23 lakh), Atria Convergence Technologies (ACT) 0.14 crore (1.40 million, 14 lakh), Hathway Cable & Datacom (Hathway) 0.079 crore (0.79 million, 7.9 lakh) and MTNL 0.077 crore (0.77 million, 7.7 lakh).

While the public sector BSNL’s subscriber base remained stagnant, its smaller public sector sibling MTNL lost 10,000 subscribers, as well its fourth rank in terms of number of wired broadband subscribers in Jan-19 to Hathway which had added 10,000 subscribers in the same period. The other player – ACT also added 10,000 subscribers in Jan-19.