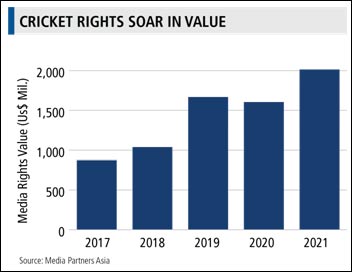

MUMBAI: Global media rights for cricket topped US$1 billion for the first time in 2018 and will likely top US$2 billion in 2021, according to a new report published today by Media Partners Asia (MPA). The report, called The Future of Cricket, suggests that cricket’s future prospects can be optimized even further if cricket boards and authorities implement structural changes while reallocating resources to meet global potential and growing consumer demand.

Commenting on the report’s findings, MPA executive director Vivek Couto said:

“Cricket is Asia’s biggest sport in terms of viewership and has successfully absorbed three different game formats. Audiences and fans have moved rapidly to shorter formats, allowing new avenues for monetization as digital distribution accelerates. Cricket boards now need to harness new audiences and markets as digital content formats open up for monetization.”

The report identifies four main growth drivers for cricket:

1. Digital innovation. Theexplosion of smartphones and broadband connectivity has boosted consumption of live matches. In the first three weeks of IPL 2019, more than 267 million viewers accessed the league via Hotstar, India’s premier sports and entertainment streaming platform. Auxiliary digital services such as fantasy gaming and live VR are also driving overall engagement.

2. Cricket clubs. Club cricket has instilled global standards of professionalism, playing a part in expanding cricket’s appeal to family fanbases. Club cricket has also become one of the most definitive means to identify and nurture talent. Clubs require an expanded window, including the possibility of having the world’s best domestic clubs play each other every year.

3. A well-defined calendar & formats. A calendar with appropriate and exclusive windows for club T20s and international cricket can grow all game formats. Boards must re-emphasize multilateral competitions for ODIs and T20s, while the proposed World Test Championship will probably need to be restructured.

4. Women’s and youth based cricket. Growing adoption of women’s and youth-based tournaments, together with the related demographic split of the audience, offers an opportunity to introduce cricket to new fans. Club-based domestic T20s are likely to provide the ideal path to invest in this endeavor.

Three key markets – India, Australia and England – accounted for 90% of the value of cricket’s global media rights in 2018. The value of global media rights will reach US$1.7 billion in 2019, driven by the ICC ODI Cricket World Cup in June. Cricket is already one of the top ten sports worldwide in terms of media valuation. MPA estimates that cricket’s valuation will top US$2 billion in 2021, with the ICC T20 Cricket World Cup likely to be held in India that year.

The game’s growing value is largely due to cricket’s youngest and shortest format, Twenty20s (T20s). ODIs and test cricket formats, played by 12 national teams, need to be revitalized as they lack relevance and lag in monetization. The popularity of test cricket in particular is declining, with both stadium attendance and TV viewership eroding steadily over the last five years. Nonetheless, a critical mass of traditional fans still follow test cricket.