According to the National Sample Survey Organisation (NSSO) ‘rural’ is an area with a Population Density of 400 per sq km and villages with clear surveyed boundaries but no municipal board. Min 75% male working population has to be involved in agriculture & allied activities. RBI defines rural areas as those areas with a Population less than 49,000 (tier -3 to tier-6 cities). This definition governs the agricultural credit given by banks and NBFCs.

Laqshya Media Group’s latest report gives us a sneak peek into startling data about the growth and innovation in Rural India and its industries, including agriculture, fertilizers, tractors, building materials and FMCG. It highlights the geographical areas that hold potential, even as the urban markets are slowed down by the pandemic. It spotlights the districts that have low infections and high GDP values and it showcases the infrastructural opportunities that the private sector should consider for long term profitability.

Agriculture in India has come a long way. India is a massive producer of food grains, horticulture, cash crops, milk and livestock-related products, resulting in India being self-sufficient in feeding its 1.37 billion population. Along with the growth in agriculture and livestock, there is also a quantum jump in India’s investment in Rural Infrastructure, which is a huge opportunity for all the mainline industries.

India is the largest producer of milk, pulses, jute, etc. and the second largest in crops like rice, wheat and tea. Agriculture contributes 17% to the Indian GDP and 45% to employment generation. India is home to the world's highest-selling Tractor brand (M&M) and the world's largest fertilizer cooperative (IFFCO). It is also the 2nd largest producer of cement.

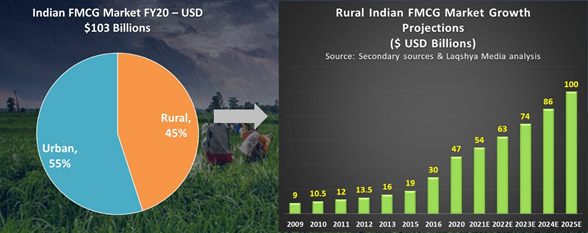

In India approx. 270 Mn rural consumers (35%) have discretionary spending powers, helped by improved agricultural practices and better access to markets. Rural Market constitutes the following

40% of FMCG sales – estimated to rise to USD $100 billion by 2025

50% of motorbike sales

38% of Cement Sales (out of residential cement)

~8-10% of e-commerce estimated to rise to $10-$12 billion by 2025

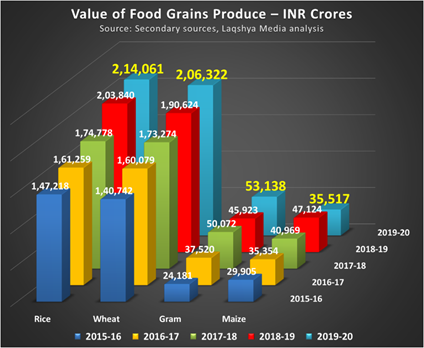

GOI’s intent to double farmers’ income in 7 years (from 2015-16 to 2022-23) – GOI’s intent marked a significant departure of the past when the emphasis had been only on production rather than its marketability. In addition, public funding on infrastructure and food grains procurement will give a significant boost to the rural population.

The report also talks about case studies of initiatives carried out by big brands in rural India. It talks about ITC’s e-choupal Baareh Mahine Hariyali, Mahindra’s Rural Housing Finance with easy loans, Amazon’s Handmade initiative and Rural Distribution Centres, Flipkart’s Motorola for Rural Markets initiative and IFFCO’s Indian Cooperative Digital Platform.

Opportunities in Rural India are wide and varied. Brands can grow by capitalizing on the currently increasing incomes and aspirations of the rural buyers.

The momentum in the rural economy can be built on by fulfilling the need gaps that are holding back higher growth of the rural economy including higher productivity of crops and more capacity for processing of crops.

Engagement with the Rural population should be customized with hyperlocal solutions.

“Rural India constitutes 66% of the country’s population. Over the last few years Rural India’s contribution to the overall GDP has dipped but there are also innumerable opportunities for growth. Good monsoons have boosted crop production in the last year and much investment has been made for improving infrastructure. Many gaps are noticeable which if fulfilled can give a great boost to the Indian economy. In the current Covid-19 situation we have also looked into the top districts in 9 states of India. 126 out of 281 districts across 5 states has less than 1000 active cases and contributes nearly 60% to the GDP. These 126 districts constitute 139,641 villages with great potential for an increase in production and consumption. So, with the correct planning, huge opportunities lie here for marketers.” Atul Shrivastava, CEO, Laqshya Media Group.

Follow Tellychakkar for the consumer facing news & entertainment

Follow Us

Follow Us