NEW DELHI: The Covid-2019 pandemic has pushed the Indian advertising market at least two years back, but 2021 will witness a growth of 26 per cent in adex, taking it to Rs 68,325 crore, a recently released report by Pitch Madison predicts.

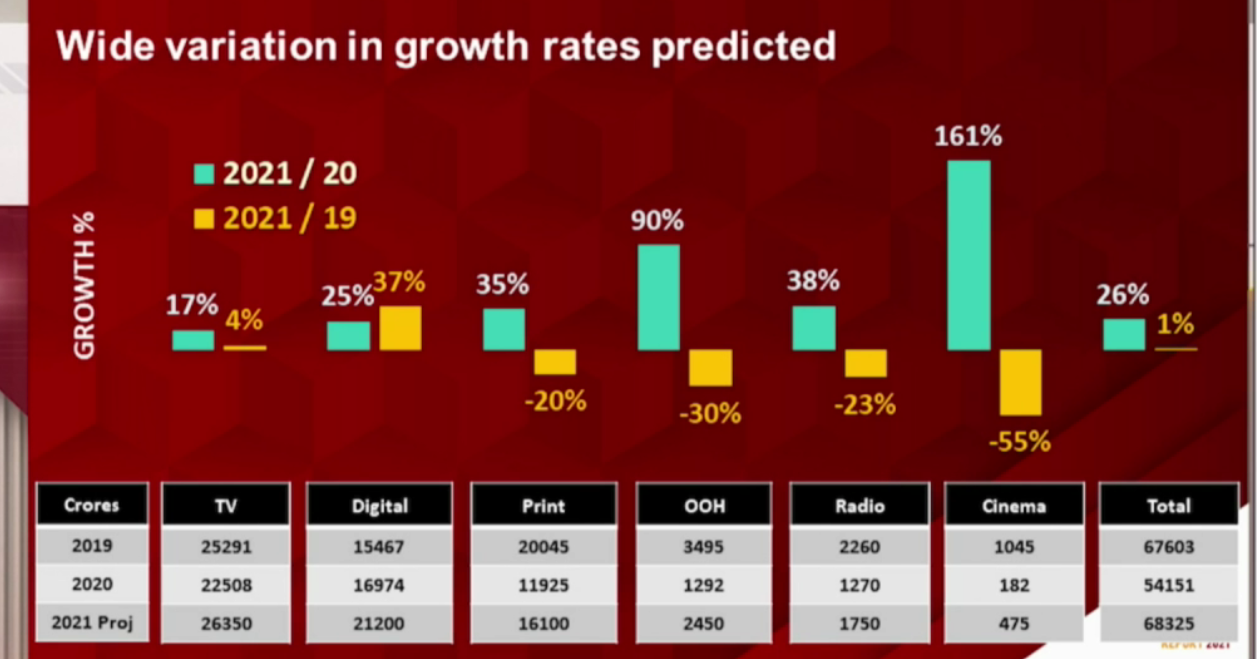

While launching the report, Madison World CMD Sam Balsara noted, “In absolute terms, adex has degrown from Rs 67,603 crore to Rs 54,151 crore in 2020, a drop of a whopping Rs 13,452 crore, the highest ever drop in one year in the history of Indian adex. The last time Indian adex has seen any negative growth was way back in 2009 when on account of the Lehman crisis, Indian adex had degrown by nine per cent. At Rs 54,151 crore adex today has gone back to the level it had achieved in 2017 and if you look at only traditional adex, then it has gone back to the level that we achieved five years ago in 2015.”

However, since commercial activities have “returned with a vengeance” post the massive slowdown in FY2021, India holds the potential to be the fastest-growing advertising market in the world, added Balsara. Following close behind will be the UK, estimated to grow by 14.7 per cent, and Australia predicted to grow by 13.2 per cent by WARC.

The report attributed this growth to big sporting events like the IPL, ICC T20 World Cup, and the Olympics, along with political ad spends during the election season. Apart from that, more categories are expected to revive after a year-long hiatus – FMCG marketers are predicted to go bullish as the economy revives, and new launches are upcoming in the auto sector. Advertisers in OTT, ed-tech, mobile gaming, and digital wallet payments categories are also expected to continue their investments in ad spends, that substantially increased over the last year.

Traditional and digital both will have an almost identical growth in the year, stated the report, with the former growing by 27 per cent over the last financial year, and the latter by 25 per cent.

Television is predicted to grow by 17 per cent to reach Rs 26,350 crore, digital by 25 per cent to reach Rs 21,200 crore, print by 35 per cent to reach Rs 16,100 crore, and OOH by 90 per cent to reach Rs 2,450 crore, over 2020. The biggest growth of 161 per cent will be witnessed in cinema, which went down as much as 55 per cent in 2020 due to the complete shutdown of theatres.

In terms of market shares, television will continue to hold the biggest slice of the pie at 39 per cent, followed by digital (31 per cent), press (24 per cent), outdoor (four per cent), radio (three per cent), and cinema (one per cent).