Mumbai: The premium video-on-demand (VOD) landscape in Southeast Asia continues to grow revenues at a double-digit pace with viewership relatively robust, as revealed by the latest analysis conducted by ampd, the digital measurement platform owned and operated by Media Partners Asia (MPA).

Southeast Asia’s premium VOD category generated more than 230 billion minutes in viewership over 1H 2024, up four per cent Y/Y, driven by growth in the Philippines and Indonesia. Category revenues, including subscription fees and advertising sales, grew 11 per cent Y/Y to US$895 million with gains across the region’s five main markets, Indonesia, Thailand, Malaysia, Philippines and Singapore. Indonesia continues to retain the first position in terms of revenues. The region added one million net new SVOD subscriptions over 1H 2024 to reach 48.8 million, representing Y/Y growth of 5 per cent. Philippines, Thailand and Malaysia led customer growth.

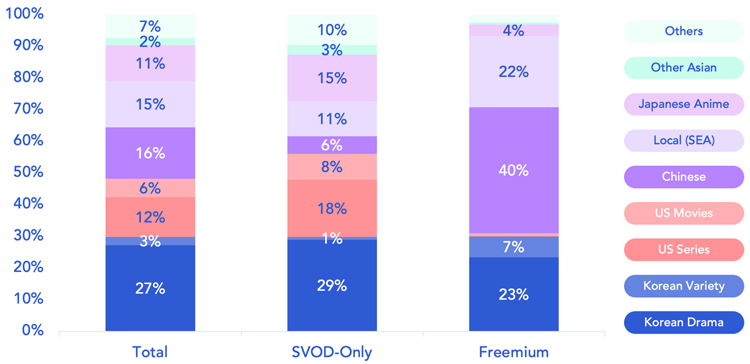

MPA executive director Vivek Couto said: “While price increases have moderated customer growth, growing penetration beyond the major urban centers in Indonesia, Philippines and Thailand remains a major opportunity as premium sports, local, Asian and US content moves online. Korean, US, Chinese & Japanese content captured 80 per cent of premium VOD viewership in Southeast Asia in 1H 2024. While Korean content remains the major driver, Chinese dramas are increasing freemium viewership. US content remains the leading acquisition funnel across global services. Local content maintains strong reach, with acquisition impact.”

Netflix and Viu both grew revenues at a significant double-digit pace in 1H 2024. Netflix’s share of category viewership reached 50 per cent in 1H 2024 overall, dominating viewership in Malaysia, Philippines and Singapore but facing strong local competition and more complex category dynamics in Indonesia and Thailand. Netflix’s category revenue share, including ads, reached 40 per cent in 1H 2024. Viu had 10 per cent viewership and category revenue share in 1H 2024. In spite of shedding subs, Disney+ revenues continue to grow as the service focuses on a higher ARPU customer funnel. WeTV retained a robust category engagement share in SEA at eight per cent in 1H 2024. Amongst local players, Vidio leads in Indonesia with 20 per cent category revenue share in 1H 2024 and 17 per cent viewership share, driven by heartland local dramas and sports. Thailand’s True ID led Thailand with 27 per cent premium VOD category viewership share though it remains second to Netflix in revenue share.

Premium VOD viewership in Southeast Asia (1H 2024)

Source: ampd

Follow Us

Follow Us