Mumbai: A million subscribers submitted their requests for Mobile Number Portability (MNP). With this, the cumulative MNP requests increased from 962.53 million at the end of March 24 to 973.60 million at the end of April 24, since the implementation of MNP. The number of active wireless subscribers (on the date of peak VLR) in April 2024 was 1057.66 million.

I. Broadband Subscriber

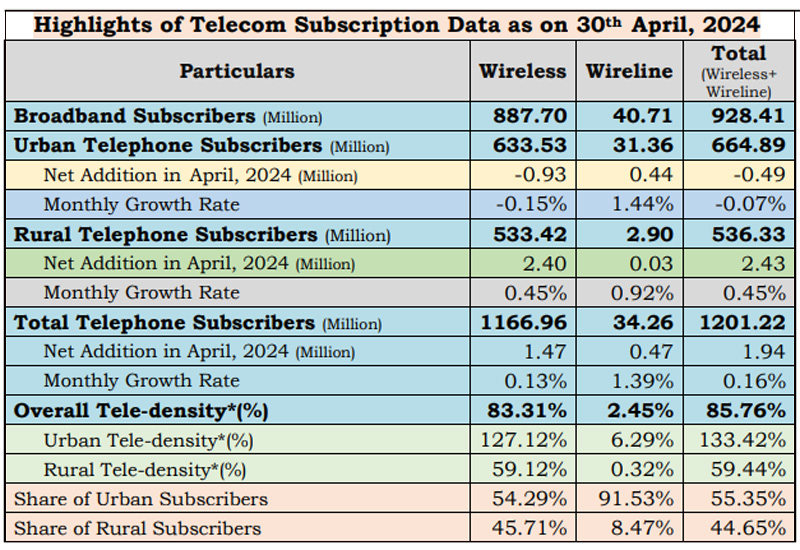

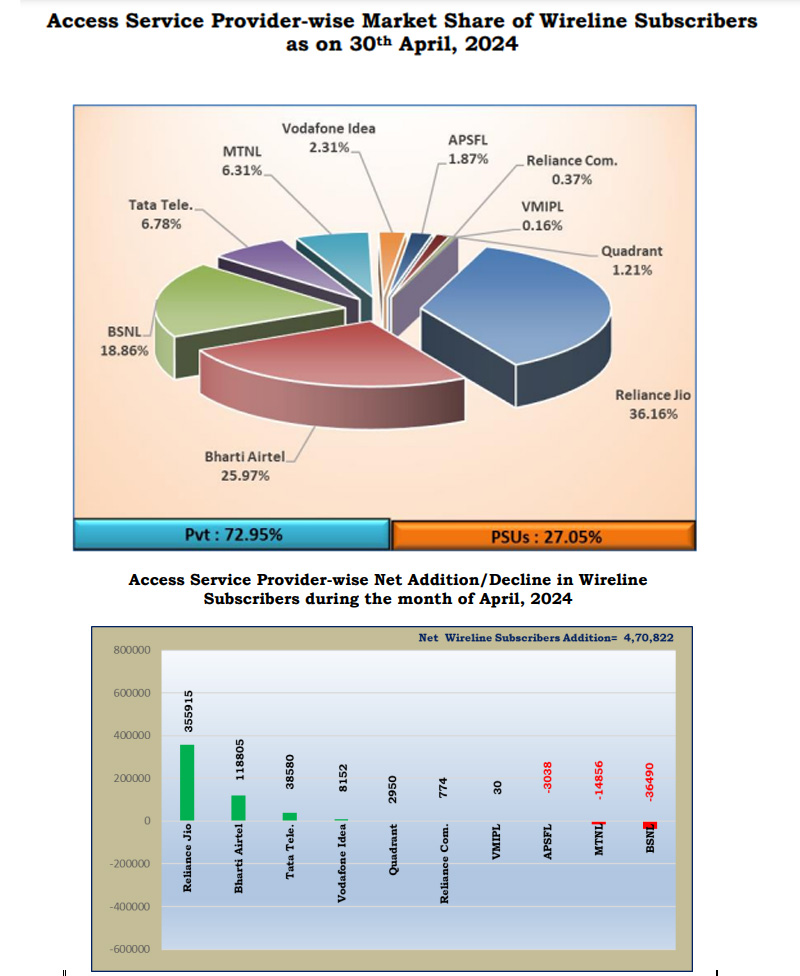

As per the information received from 1,203 operators in April 2024, in comparison to 1158 Operators in March 2024, the total Broadband Subscribers increased from 924.07 million at the end of March 24 to 928.41 million at the end of April 24 with a monthly growth rate of 0.47 per cent. Segment-wise broadband subscribers and their monthly growth rates are as below: -

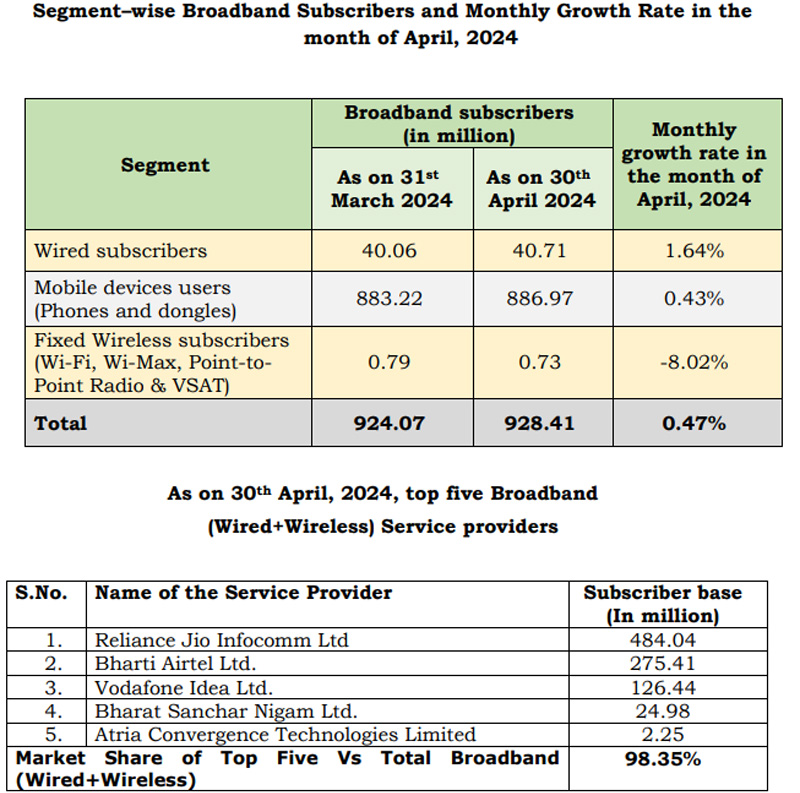

• The graphical representation of the service provider-wise market share of broadband services is given below: -

II. Wireline Subscribers

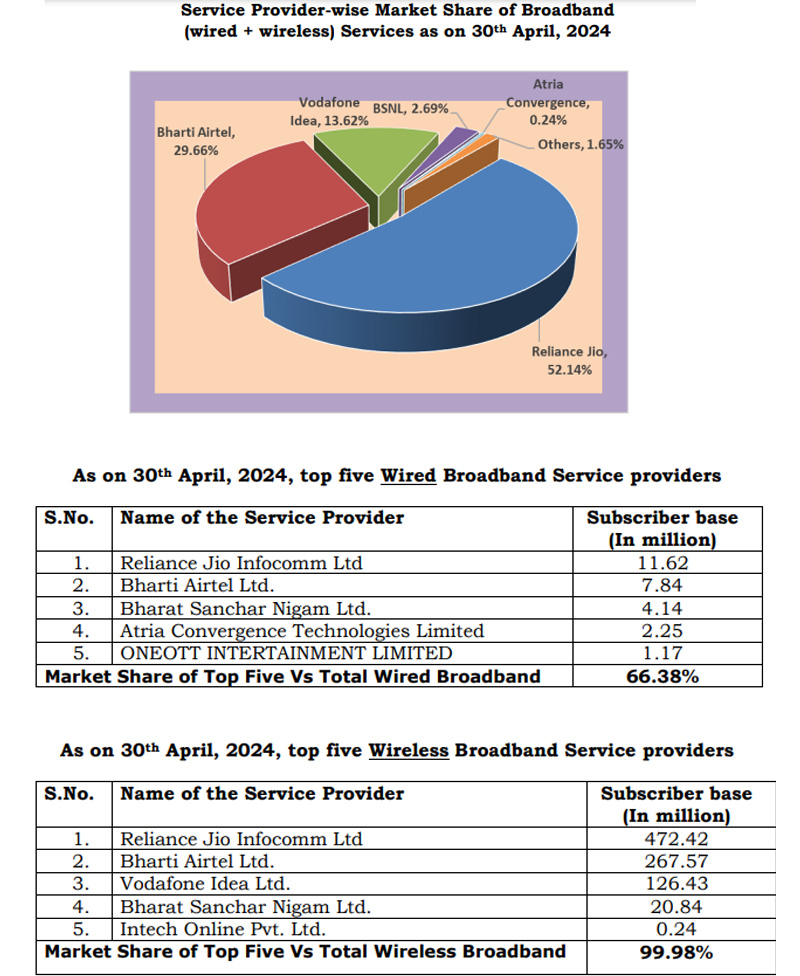

• Wireline subscribers increased from 33.79 million at the end of March-24 to 34.26 million at the end of April-24. Net increase in the wireline subscriber base was 0.47 million with a monthly rate of growth 1.39 per cent. The share of urban and rural subscribers in total wireline subscribers were 91.53 per cent and 8.47 per cent respectively at the end of April, 2024.

• The Overall Wireline Tele-density in India increased from 2.41 per cent at the end of March-24 to 2.45 per cent at the end of April-24. Urban and Rural Wireline Tele density were 6.29 per cent and 0.32 per cent respectively during the same period.

• BSNL, MTNL and APSFL, the three PSUs access service providers, held 27.05 per cent of the wireline market share as on 30th April, 2024. Detailed statistics of wireline subscriber base are available at Annexure-I.

III. Wireless subscriber

• Total wireless subscribers increased from 1,165.49 million at the end of March 24, to 1,166.96 million at the end of April 24, thereby registering a monthly growth rate of 0.13 per cent. Wireless subscription in urban areas decreased from 634.47 million at the end of Mar-24 to 633.53 million at the end of Apr-24 however wireless subscription in rural areas increased from 531.02 million to 533.42 million during the same period. Monthly growth rate of urban and rural wireless subscription was -0.15 per cent and 0.45 per cent

respectively.

• The Wireless Tele-density in India increased from 83.27 per cent at the end of March-24 to 83.31 per cent at the end of April-24.

• The Wireless Tele-density in India increased from 83.27 per cent at the end of March-24 to 83.31 per cent at the end of April-24.

The Urban Wireless Tele-density decreased from 127.51 per cent at the end of March-24 to 127.12 per cent at the end of April-24 however Rural Tele-density increased from 58.87 per cent to 59.12 per cent during the same period. The share of urban and rural wireless subscribers in total number of wireless subscribers was 54.29 per cent and 45.71 per cent

respectively at the end of April-24. Detailed statistics of wireless subscriber base is available at Annexure-II.

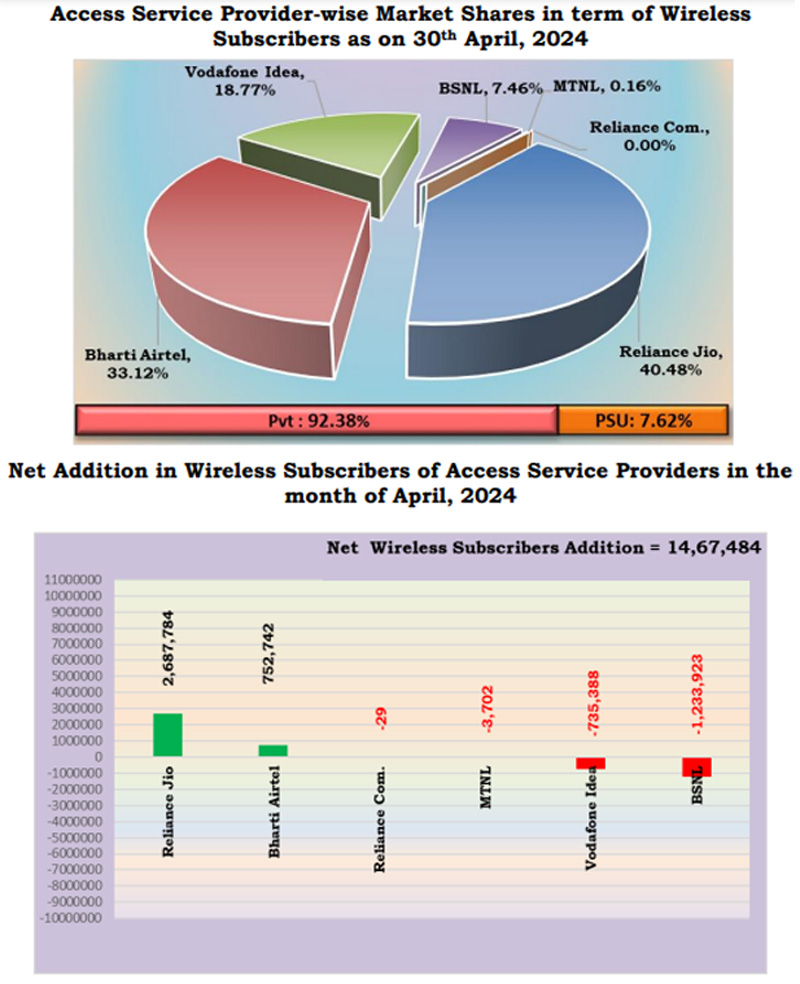

• As on 30th April, 2024, the private access service providers held 92.38 per cent market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 7.62 per cent.

• The graphical representation of access service provider-wise market share and net additions in wireless subscriber base are given below: -

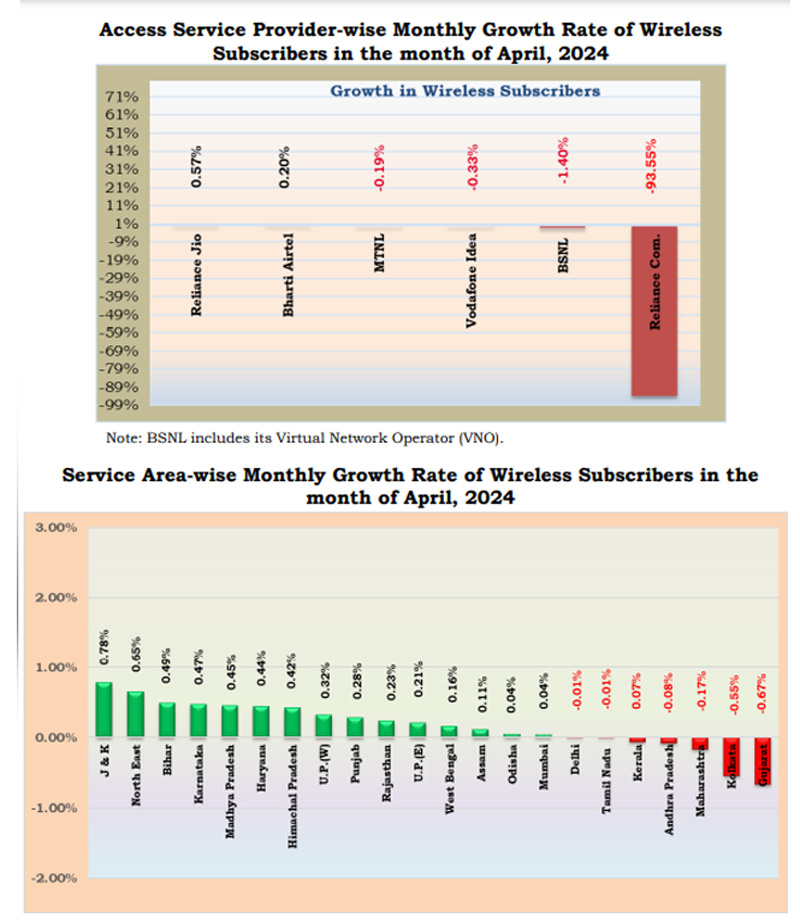

Growth in Wireless Subscribers

• Except Delhi, Tamil Nadu, Kerala, Andhra Pradesh, Maharashtra, Kolkata and Gujarat, all other service areas have showed growth in their wireless subscribers during the month of April 24.

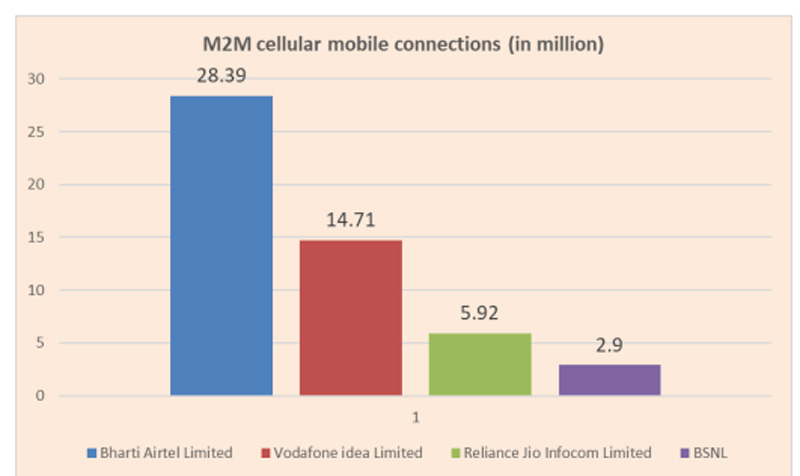

M2M cellular mobile connections

As on 30.04.2024, there were 51.92 million M2M cellular mobile connections. Bharti Airtel Limited has the highest number of M2M cellular mobile connections 28.39 million with a market share of 55.69 per cent followed by Vodafone idea Limited, Reliance Jio Infocom Limited and BSNL with market share of 28.32 per cent, 11.41 per cent and 5.58 per cent respectively.

IV. Total Telephone Subscribers

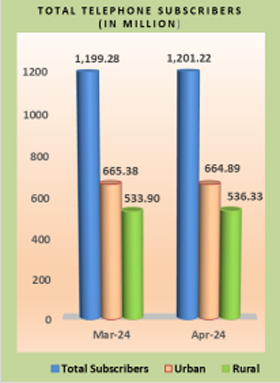

• The number of telephone subscribers in Total Telephone Subscribers India increased from 1,199.28 million at the end of March-24 to 1,201.22 million at the end of April-24, thereby showing a monthly growth rate of 0.16 per cent. Urban telephone subscription decreased from 665.38 million at the end of March-24 to 664.89 million at the end of April-24 however the rural subscription increased from 533.90 million to 536.33 million during the same period. The monthly growth rates of urban and rural telephone subscription were -0.07 per cent and 0.45 per cent respectively during the month of April-24.

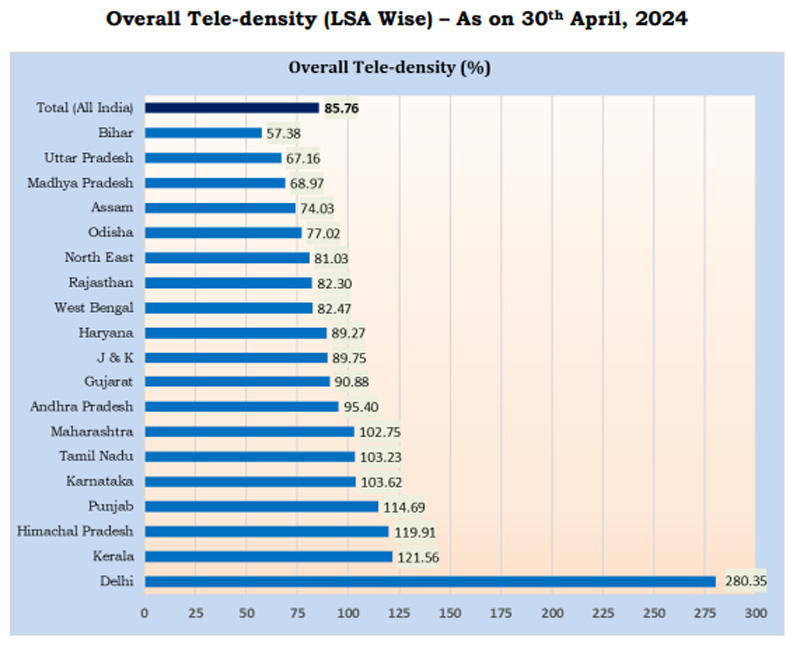

• The overall Tele-density in India increased from 85.69 per cent at the end of March 24 to 85.76 per cent at the end of April 24. The Urban Tele-density decreased from 133.72 per cent at the end of March 24 to 133.42 perent at the end of April 24 however Rural Tele-density increased from 59.19 per cent to 59.44 per cent during the same period. The share of urban and rural subscribers in total number of telephone subscribers at the end of April-24 were 55.35 per cent and 44.65 per cent respectively.

• The overall Tele-density in India increased from 85.69 per cent at the end of March 24 to 85.76 per cent at the end of April 24. The Urban Tele-density decreased from 133.72 per cent at the end of March 24 to 133.42 perent at the end of April 24 however Rural Tele-density increased from 59.19 per cent to 59.44 per cent during the same period. The share of urban and rural subscribers in total number of telephone subscribers at the end of April-24 were 55.35 per cent and 44.65 per cent respectively.

• As may be seen in the above chart, eight LSA have less tele-density than the all India average tele-density at the end of April-24. Delhi service area has a maximum tele-density of 280.35 per cent and the Bihar service area has a minimum tele-density of 57.38 per cent at the end of April-24.

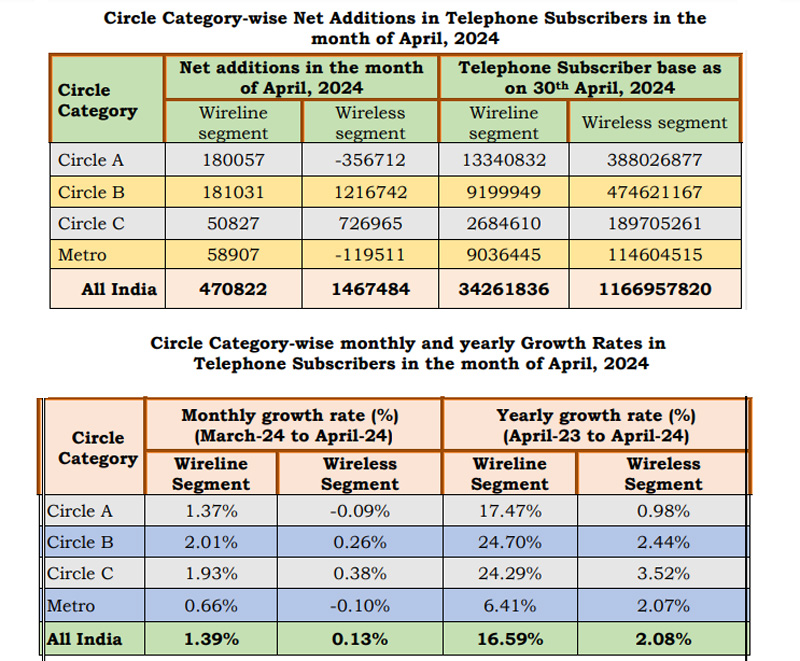

V. Category-wise Growth in subscriber base

• As can be seen in the above tables, in wireless segment, during the month of April, 2024, on monthly basis except Circle ‘A’, and Circle ‘Metro’ all other circles have registered growth rate in their subscriber base. On yearly basis all circles have registered growth rate in their subscriber.

• In Wireline segment, during the month of April, 2024, both on monthly and yearly basis, all circles have registered growth rate in their subscriber base.

VI. Active Wireless Subscribers (VLR Data)

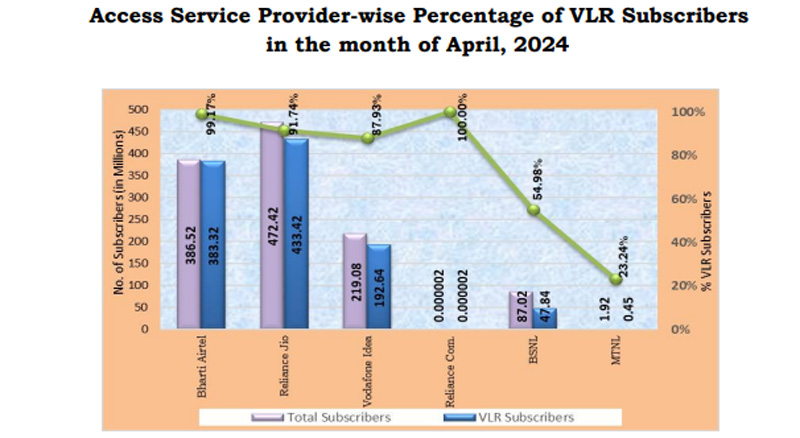

• Out of the total 1,166.96 million wireless subscribers, 1057.66 million wireless subscribers were active on the date of peak VLR in the month of April-24. The proportion of active wireless subscribers was approximately 90.63 per cent of the total wireless subscriber base.

• The detailed statistics on proportion of active wireless subscribers (also referred to as VLR subscribers) on the date of peak VLR in the month of April-24 is available at Annexure III and the methodology used for reporting VLR subscribers is available at Annexure-IV.

• Reliance Communications has the maximum proportion 100 per cent of its active wireless subscribers (VLR) as against its total wireless subscribers (HLR) on the date of

peak VLR in the month of April-24 and MTNL has the minimum proportion of VLR 23.24 per cent of its HLR during the same period.

Follow Us

Follow Us