NEW DELHI: While Covid2019 has had an unprecedented impact over businesses across the country in the past few months, the media and entertainment consumption witnessed some interesting upward trends during the time period. As per weekly data shared by BARC-Nielsen during the course of the nationwide lockdown, TV viewership peaked by 43 per cent (highest value, at week 13 as compared to pre Covid2019 i.e. Week 2 to Week 4), during the period. Time spent on TV was up by 7 per cent in week 20, as compared to the pre-covid2019 period. News genre was one of the biggest gainers when it came to viewer interest and eyeballs, with total viewership up by 15 per cent in week 20.

Malayalam news channels also witnessed a similar trend, recording a 141 per cent hike in viewership, recorded in week 20. However, this growing viewership did not result in the sort of advertising revenue it would have garnered in pre-covid2019 days.

While the number of advertisers did not see much of a dip across Malayalam news channels; as shared by TAM AdEx India, the number of advertisers in pre-covid days (Jan-March’20) was 440 and dipped to 352 in covid times (April 20-June 20), the ad revenues went down by as much as 40-60 per cent due to lower inventory pricing, shares an industry insider.

Madison Media chief buying officer Vinay Hegde shares with Indiantelevision.com, “Typically with the pandemic and the lockdown becoming the focal point, viewership as in other markets shifted to news and the spike was exponential. A major shift from GECs to news was inevitable and visible and the channels did their best to hold on to their rates and monetise on the spike. This genre managed to rake in some ad revenues, yet inventory fill rate was lower than the normal average. April actually saw a dip in ad spends by almost 25 per cent Q4 of LY, but in May there was a massive spike of 120 per cent.”

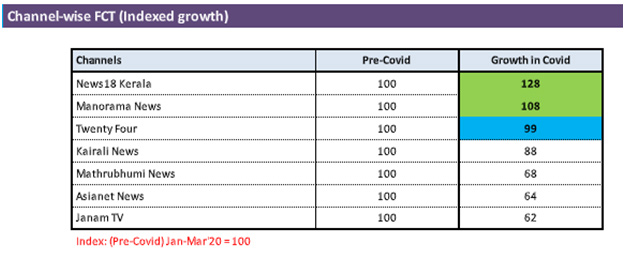

When it comes to FCTs, Mplan CEO Parag Masteh shares that the numbers were more or less similar for the top channels, as compared to pre-covid2019 times, with some even recording positive growth.

TAM AdEx India data reveals that News18 Kerala and Manorama News witnessed positive ad volume growth of 28 per cent and eight per cent, respectively, the ad volumes of channel 24 remained almost similar to pre-covid2019 times.

Mathrubhumi News CEO Mohan Nair says, “While we witnessed a 25 per cent spike in viewership during the period, the ad revenues dipped. I may say that because we couldn’t record some of our outdoor programmes and the news coverage was also centred primarily on Covid2019, for nearly two months we had hardly any business. If I look at these three months, we must have recorded a business of around 30 per cent of the pre-covid days.”

Kairali News’ Suresh Kumar quips, “The FCTs dropped drastically for us and so did the advertiser number. There were very few regular clients from the jewellery segment who were active on our channel and most of the ad space was brought by government ads and the hospitals. Our ad revenues used to touch Rs one crore per month before Covid2019 and for the past three months, the figure stands below 50 per cent. One of the reasons is that we had to bring down our inventory prices by 30 per cent in most cases.”

Asianet News Network VP sales and marketing Unni Krishnan shares, “Though we recorded 3x ratings, the advertiser sentiment was really low. If you look at the Kerala ad market, retail clients are amongst the top advertisers on news channels and they were not active at all in the initial days. Though they are trying to make a comeback, it is not with the same budgets as they used to spend earlier. In fact, most of our major clients were not active during the past few months and the only ads we got were from some new clients.”

He adds, “These were not big-time clients. To give some numbers, if on a normal day a client used to come with an investment of Rs five lakh to Rs 10 lakh, we were getting billings of up to Rs 50,000 to Rs one lakh only. So, if you look at the number of advertisers, we used to get the same revenue from 10-20 clients earlier, which we got from 40-50 clients now.

While Kumar, Nair and their teams reworked their inventory prices and announced some discounts to keep up the advertiser sentiment, Krishnan avoided changing ad rates.

“While most of our competitors were announcing discounts and combo packages to keep the advertiser sentiment positive, we at Asianet avoided it. It definitely caused us a bit of a loss in the initial days, and we had a slow start in April, but fortunately for us, the ratings improved. We also did not increase our inventory prices when the viewership peaked,” Krishnan highlights.

Nair shares, “The good thing that happened during the pandemic is that categories which earlier refrained from advertising on news genre like sanitisers and washing-related products have started advertising on our channels. While I am hopeful that the upcoming monsoon and Onam will bring in some positive movement from advertisers, if you look at Kerala, Covid2019 cases are again rising. And we can’t be sure what the situation will be in the coming months.”

Krishnan elucidates, “Kerala was the first state to recover, but if you look at some other markets like Chennai or Mumbai, the lockdown is still in place and the numbers of patients are continuously rising. Even in Kerala, fresh cases are coming up, and while earlier the number was 20-30 cases a day, it has now peaked to 120-130. Our all yoy projections have already gone for a toss. While Onam and monsoon are a good season for us, we can’t be sure of the situation then. Yes, July, which usually is dull for the Kerala news market, has shown signs of improvement for us; going ahead, market sentiments largely will decide our fate.”

As the lockdown restrictions ease and the bright festive period approaches, starting August, the channels are expecting their fortunes to improve but they are still apprehensive of the growing cases.

Follow Us

Follow Us