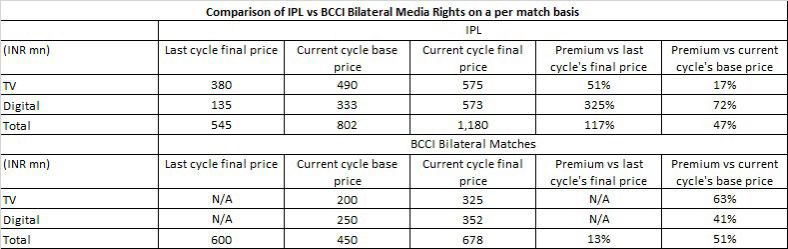

Mumbai: BCCI bilateral rights for 88 matches have been sold of INR 59.6 bn (8 per cent below our estimated range of INR 65bn-INR 75bn, link - https://tinyurl.com/2u8v8xrm) which is 13 per cent higher on a per match basis vs the earlier cycle (43 per cent lower vs IPL on a per match basis).

* Whilst comparing this with IPL, premiums vs base price for TV/digital in IPL per match were at 17 per cent /72 per cent on an already high base price, whereas in the case of these bilateral matches, premiums vs base price for TV/digital per match basis is 63 per cent /41 per cent vs base price (base price was set much lower than earlier cycle’s final price per match). In our view, TV premium compared to base price could been higher than digital, due to Viacom 18 bidding aggressively for her same as one platform having both (TV and digital rights) lead to better advantage on bundling and higher negotiating leverage with advertisers

* Overall premiums (vs earlier cycle) for these rights been much lower vs IPL due to 1) lower number of T20 matches, 2) less interest in bilateral matches with a large tournament like IPL garnering interest on home grounds already, 3) lesser number of platforms bidding for the same and 4) a poor ad environment over the last one year; IPL had attracted a premium of 117 per cent on a per match basis vs it’s last cycle price, whereas these rights have come at a premium of mere 13 per cent on a per match basis vs it’s last cycle’s price.

Further, in this case, the cost of per match on digital has surpassed cost of per match on TV , as digital is 8% higher on a per match basis; in the case of IPL - TV and digital were largely on par on a per match basis

Earlier cycle of the bilateral rights was not unbundled hence there isn’t a comparison on TV/digital rights basis per match

We believe that a single entity securing both TV and digital rights is mutually advantageous, as it enhances the negotiating leverage of the platform. This allows them to offer bundled options to advertisers. In contrast, when two separate players acquire TV and digital rights, it fuels competitive rivalry between platforms, resulting in a dampening effect on overall revenues (IPL revenues were down YoY in CY23); we believe bundling prevents advertisers holding a stronger bargaining position as compared to the platforms.

Acquisition of BCCI bilateral rights will also enable Jio cinema to become even bigger in the Indian OTT ecosystem; the platform has an AVOD market share of ~22-24% already in CY23, after factoring IPL revenue and other content; revenues can scale up further due to these bilateral rights; this in turn will intensify competition in the OTT segment and work negatively for other broadcast-based OTT players like Sony, Zee, Disney+Hotstar. It will also continue to negatively impact SVOD revenue growth for Indian OTT, as Jio Cinema may continue to offer content free

On the TV side, this is Viacom’s first large scale cricket acquisition, as IPL and WC rights on cricket for TV are with Star/Zee respectively.

The credit of this article goes to Elara Capital SVP Karan Taurani

Follow Us

Follow Us