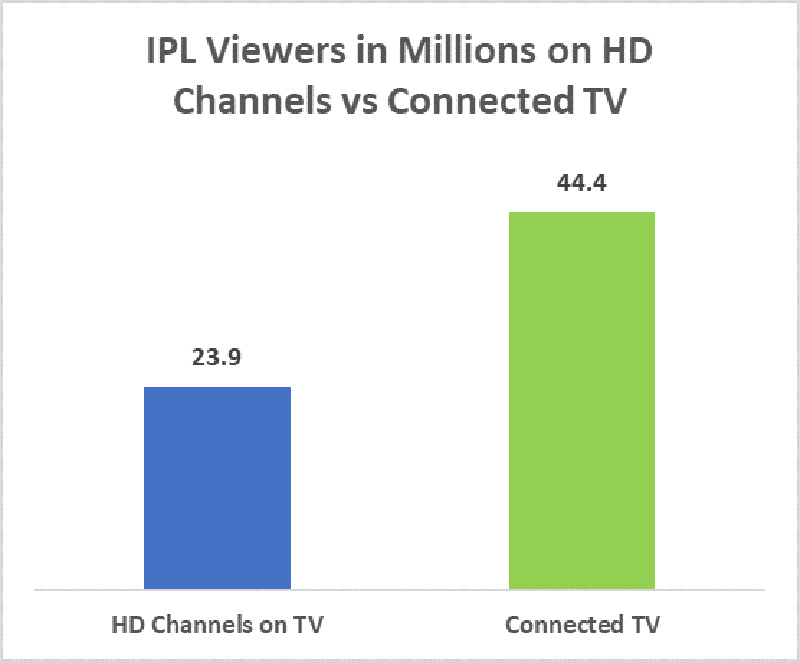

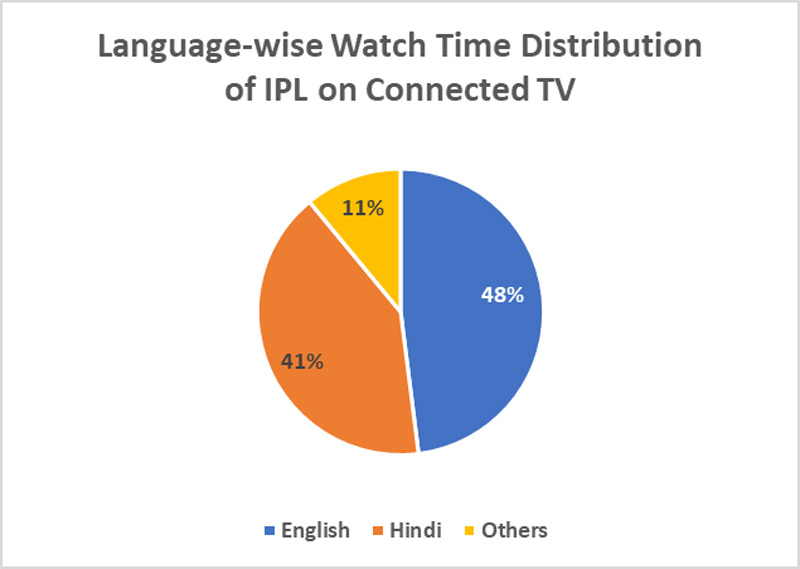

The ongoing TATA IPL has witnessed a significant shift in consumer behaviour, with Connected TVs (CTV) eating into HD TV viewership in a big way. Data from BARC shows that CTV viewership for TATA IPL accounts for 44.4 million, nearly double of HD TV Viewership of 23.9 million. As the popularity and significance of digital services continue to grow among the masses, premium cosmopolitan audiences particularly are opting to watch live sports via CTVs. This trend highlights the growing consumer affinity for consuming live sports via digital platforms. As things stand, the contribution of English-speaking audiences takes a bigger share of the CTV pie.

Here's a closer look and break-down of some of the key data

IPL HD viewership stood at a meagre 23.9 Mn viewers vs 44.4 Mn on JioCinema’s Connected TVs.

The HDTV numbers come apart further when scrutinized, as urban viewers account for about only 12.4 Mn of the 23.9 HDTV viewership, with the rest coming in from rural India. This evidences the vast divide between HDTV and CTV viewership.

The decline is not limited only to this season of TATA IPL, though. When viewed on a five-year timeline, statistics show that this season’s urban viewership contribution to HDTV is the lowest it has been since the past five seasons.

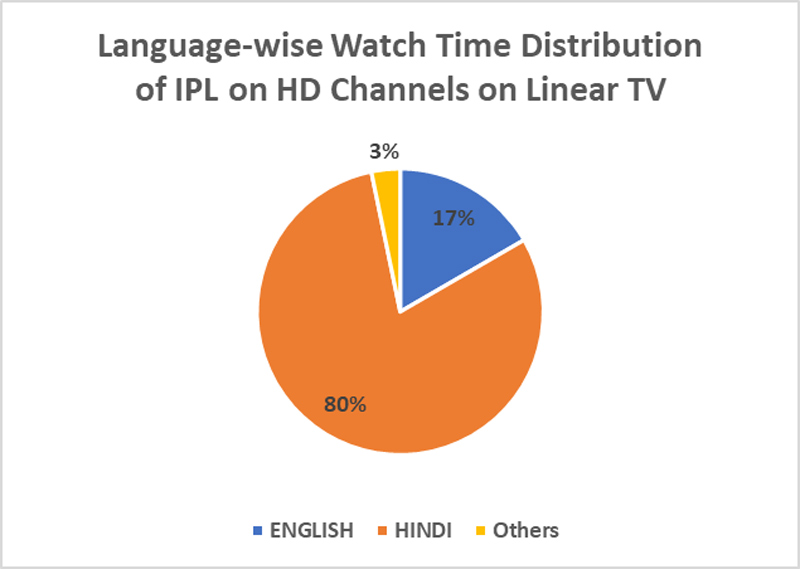

An additional point which brings alive the HDTV decline reality is the language contribution pie. TATA IPL viewers on HD channels on TV are heavily skewed towards Hindi feed, with only 17% contribution coming from the English feed.

On the other hand, CTV viewers on TATA IPL on JioCinema show way higher affinity towards English feed, where 48 % have watched the high-octane tournament in English- a stark difference when compared to HDTV for the same parameters.

Separating the Fantasies from Facts

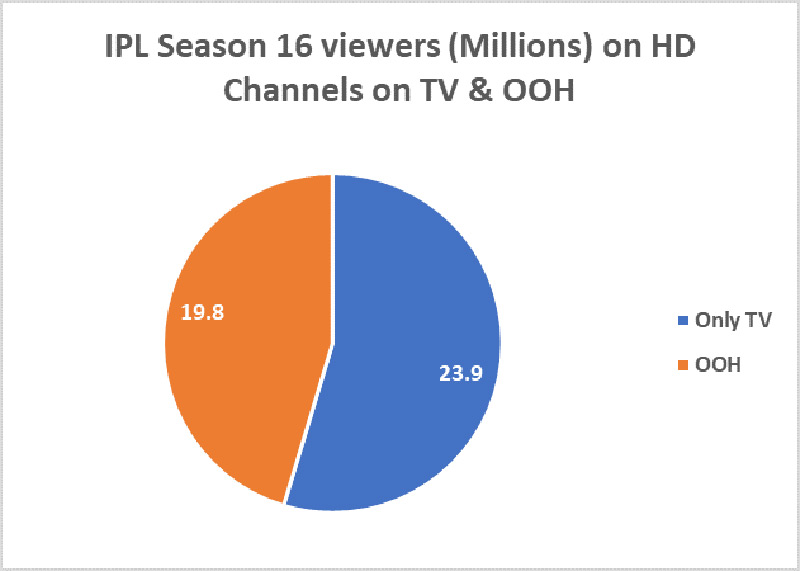

Star has claimed a higher number on HD reach of above 43 Mn, which is not a fair representation of the premium HD tv audiences. When broken down under a scanner, 19.8 Mn of the claimed 43 Mn is accounted for by OOH HD TVs. These include tv sets at establishments like malls, restaurants, bars, etc. which inflate the minuscule real figures.

Take the dilution of 19.8 Mn away, and one is left with just 23.9 Mn, which is the more accurate residential viewership of HDTV.

Why does this matter? Advertisers typically pay higher CPRP for HD Households to access premium customers in their houses to get attention for their ads. The OOH TV HD screens do not have audio on. Additionally, the profile of people on OOH is not necessarily premium.

As a result, advertisers/agencies paying for HD Pay TV households, end up truly reaching merely 23.9 Mn.

Where viewers go, advertisers follow !

Previous season no of advertisers on IPL TV HD was 62 which has come down to 28 this season (source Barc)

Most advertisers seeking premium audiences on IPL are moving away to Connected TV .This is reflected in 3x more advertisers on CTV than on HD Channels on Linear TV.