MUMBAI: Cable TV MSO and broadband major GTPL Hathway Ltd has released its audited financial results for the fourth quarter and the entire financial year, ended 31 March 2025. The board of directors, at its recent meeting, approved these results and recommended a dividend of Rs. 2.00 per equity share of Rs. 10 each, subject to shareholder approval.

Here's a snapshot of the company's standalone financial performance, with comparisons to the previous year:

For the quarter ended 31 March 2025, GTPL Hathway reported revenue from operations of Rs. 5,621.91 million, a 10.44 per cent increase compared to the same period last year, and a net profit after tax of Rs. 81.50 million, a decrease of 18.10 per cent.

For the year ended 31 March 2025, revenue from operations reached Rs. 21,933.81 million, an 8.13 per cent increase year-over-year, and net profit after tax was Rs. 478.03 million, a 37.30 per cent decrease compared to the previous year.

The company's board has proposed a dividend of Rs. 2.00 per share.

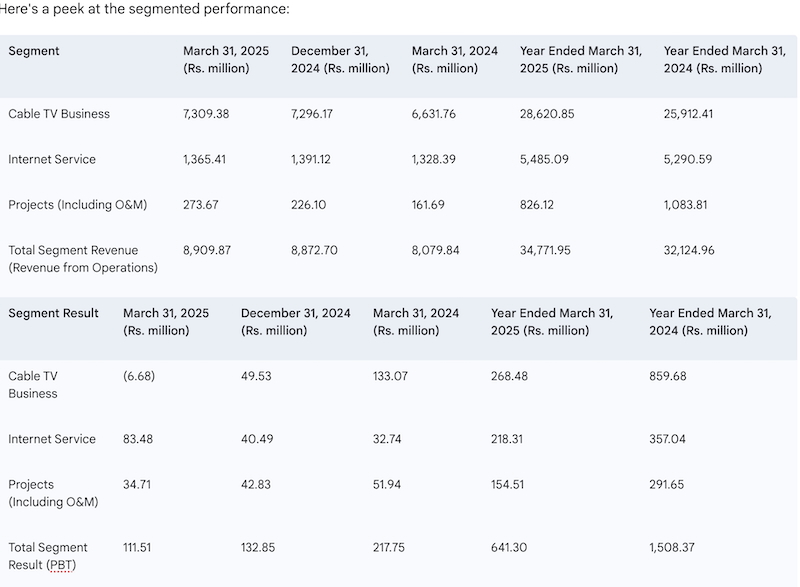

The old stager, cable TV, remains a significant contributor to GTPL Hathway's coffers, raking in Rs 28,620.85 million for the year. However, the segment's profitability has taken a hit, dropping to Rs 268.48 million, compared to a far healthier Rs 859.68 million in the previous year. The fourth quarter, in particular, saw a loss of Rs 6.68 million. The internet service segment continues its race, pulling in Rs 5,485.09 million for the year, and a profit of Rs 218.31 million.

Meanwhile GTPL Hathway has paid a one-time application fee of Rs 100 million and has obtained approval from the ministry of information & broadcasting to establish, maintain, and operate a headend-in-the- sky (HITS) broadcasting services platform for a 10-year period, in compliance with the HITS guidelines. As at 31 March 2025, the company is in the process of setting up the associated network and also obtaining other necessary licences.

A media release issued by the company had the following to say:

Q4 FY25 Total revenue stood at Rs 8,989 million a growth of 10 per cent Y-o-Y

* FY25 revenue stood at Rs 35,072 million a growth of 8 per cent annually and broadband revenue grew by four per cent annually

* EBITDA for Q4 FY25 stood at Rs 1,144 million with an EBITDA Margin of 12.7 per cent and an operating EBITDA margin of 22 per cent. For the full year, EBITDA stands at Rs 4,625 million with EBITDA Margin of 13.2 per cent with an operating margin of 22 per cent

* Q4 FY25 Profit After Tax stood at Rs 105 million and the same for FY25 is Rs 479 million

Digital Cable TV

• Active subscribers were 9.60 million as of March 31, 2025, achieving an increase by 100K Y-o-Y

• Paying subscribers stood at 8.90 million, increasing by 100K Y-o-Y

• Subscription revenue from cable TV stood at Rs 2,982 million for Q4FY25 & Rs 12,327 million for FY25

• Company signed grant of permission agreement (GOPA) with ministry of information and broadcasting for

providing headend-in-the-sky (HITS) services for a period of 10 years

Broadband

• Increase in broadband subscribers by 25K Y-o-Y thus standing at 1045K

• Broadband revenue increased by 4% to Rs 1,358 million for Q4 Y-o-Y &Rs 5,456 million for FY25

• Homepass as on 31 March 2025, stood at Rs 5.95 million – an addition of 150K Y-o-Y. Of the 5.95Mn, 75 per cent available for FTTX conversion

• Broadband average revenue per user (ARPU) stood at Rs 465 per month per sub, increased Rs 5 Y-o-Y.

• Average data consumption per user per month was 396 GB, an increase of 11 per cent Y-o-Y.

GTPL Hathway Ltd managing director Anirudhsinh Jadeja said: “It pleases me to report that the company has sustained its subscriber base across both business divisions reflecting the resilience within operations in an overall challenging industry environment. We continue to remain optimistic about our long-term strategies and our initiatives to capitalize on the evolving consumer trends.The upcoming financial year will be pivotal as we look to enhance our capabilities for distribution of TV services with material benefits expected to accrue over the medium term. We are constantly enhancing the ambit of our offerings, upgrading and implementing technological innovations and focusing on providing consumer centric services. We will continue to evaluate opportunities for growth across our businesses.”

Follow Us

Follow Us